The changing nature of active management

by Daniel Needham, Global CIO & President, Morningstar Investment Management

Key Takeaways

- Active management may not be in decline, rather the type of active management is changing to benefit active asset allocation. This presents investment opportunities for long-term asset allocators.

- Research shows that investors need to not only be active to outperform; they need to be patient.

- Long-term investing can be psychologically challenging, so it’s important investors have an adviser to keep their focus on what really matters.

All Investing is Active Investing

The move to passive investing has been a powerful trend, but to date has focused on security selection. In this context, passive refers to the replication of a market capitalisation-weighted index, while active may describe everything else. The same principle may apply to asset allocation, with passive classically defined as holding the entire investable market in proportion to the abundance of each part.

Clearly, few, if any, investors proportionally own every investable asset.[1] Therefore, almost every investor is active on some level. Furthermore, replicating an equity index such as the S&P 500 is therefore not strictly “passive” since trading is required to match the constituents of the index[2]. In this sense, the connection between buy and hold investing and passive investing can be misleading.

When we look at how assets are invested through more accurate definitions, we believe the share of actively managed assets hasn’t declined, as much as shifted, from security-selection to asset allocation.

That is, those buying exchange-traded funds (ETFs) aren’t buying them for keeps. They’re using them to express an active investment decision (sometimes to meet a client need) and often trading them frequently, invalidating the term “passive.”

On balance, this shift in active management increases the opportunity to outperform, we believe, for investment managers who are able to take broader views on asset classes, sectors, industries, and other characteristics. In turn, this may increase the opportunity for investors who are patient.

Shorter Time Horizons Hurt Investors

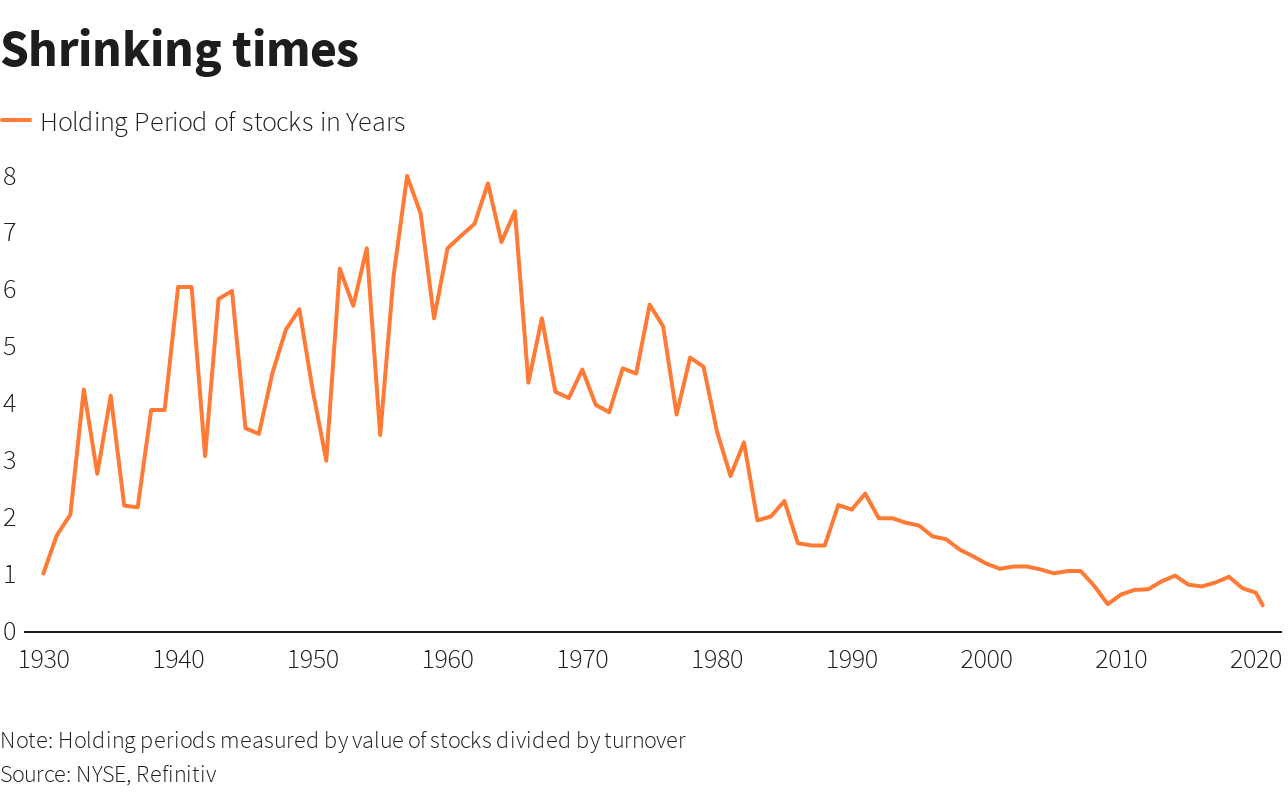

Time horizon turns out to be critical for taking advantage of investment opportunities for truly active management and receiving the benefits of compound interest—benefits that are hard to overestimate.[3] Yet, this observation contrasts with the fact that average holding periods continue to fall. Holding periods have arguably been shortened by the rise of passive management, which appears to be a contradiction given passive funds’ low turnover rates.

Exhibit 1: The reduction in holding period. Source: NYSE, Refinitiv. Note: Holding periods measured by value of stocks divided by turnover. https://www.reuters.com/article/us-health-coronavirus-short-termism-anal/buy-sell-repeat-no-room-for-hold-in-whipsawing-markets-idUSKBN24Z0XZ

If index-tracking holdings aren’t frequently buying and selling stocks, how could they contribute to shortening horizons? Because they themselves are being bought and sold. With the rise of lower-cost investment vehicles that can be traded like individual stocks, ETF volumes have risen to meaningful proportions of the market activity relative to their size. Still, it has been estimated that only about 10% of ETF volumes leads directly to the creation/redemption of shares.[4]

Despite this, it does appear that this turnover and activity impacts the underlying securities,[5] with higher volatility and turnover for stocks included within ETFs amplified by arbitrage activity—often impacting sectors, countries, industries, styles, or themes.[6]

This presents an opportunity, through active asset allocation of sectors, industries, and countries across equity markets, and for bottom-up investors that can take more active risk by including focused exposure to these areas. While the game may be getting harder in the more narrowly defined subsectors, it may be an opening for those with a long time horizon and a high active share.

By Definition, You Must Do Something Different to Outperform

According to Sir John Templeton, one of the great investors of the 20th century, it’s impossible to produce superior performance unless you do something different from the majority.

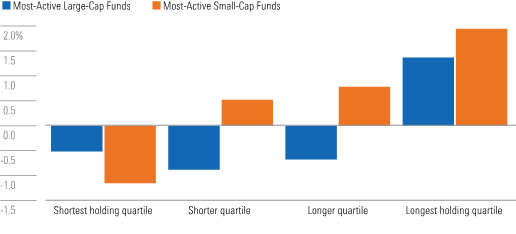

Academics call this “active share,” which is loosely defined as how different an investment strategy is from its benchmark. High active share should not be interpreted as having a higher likelihood of outperformance on its own. Like all things, one should be cautious in drawing conclusions from a single metric. On this point, author and academic Martijn Cremers[7] identified that funds with high active share and low turnover tended to do better on average. This makes sense to us.

Exhibit 2: More-active strategies held for the long run tend to outperform. Source: Cremers, M. 2016. “Active Share and the Three Pillars of Active Management: Skill, Conviction and Opportunity.” See online appendix at https://papers.ssm.com/sol3/papers.cfm?abstract_id-2891047

In our opinion, while certain strategies with lower active share and higher turnover can and do outperform, for fundamental investors time horizon seems to be the road less travelled. This concept of patient capital has been described as time horizon arbitrage and is tied to the idea of limits to arbitrage. In other words, patient investors may reap rewards—these rewards are available to any investor, but in practice go to only those who do what it takes.

Arbitrage Comes in Different Forms, Including Time Horizon

Arbitrage typically refers to different prices set for the same asset, a condition that generally requires not enough market participants seeing the big picture. The astute investor can buy at the lower price and sell at the higher one, keeping the difference.

Once, arbitrage involved buying something (gold, for example) at a lower price in one port, and sailing it to another port to sell at a higher price. With a large enough spread (and trustworthy enough sailors), anyone could take advantage of the price difference, but of course not everyone did.

Time horizon arbitrage is the idea that many investors are so focused on the short term, with lots of competition for investment results, that they don’t see the big picture, in this case the value of the investment for a long-term owner. Whether due to incentives or to psychology or career risk,[8] there’s a reluctance to extend one’s horizon. With all the focus on winning over the short-term, this reduces the competition for information that is only relevant over the long term.

While there are no doubt opportunities over short horizons for talented investors and traders, as the time horizon extends, competition appears to decline. The desire or need for quick results is the siren song for most investors. This presents an arbitrage opportunity for those willing to tie themselves to the mast and wait patiently for potential returns.

Bringing It All Together

While headlines decry the decline of active management, we may be seeing a change of active management from purely security selection to active asset allocation. This utilises portfolios of stocks, principally ETFs, rather than the underlying stocks themselves. The rise of passive management may imply less activity and longer holding periods, however the opposite may be occurring.

With the rise of active asset allocation through ETF trading, we see an opportunity for asset managers willing to be different, taking a long-term view. As the security selection asset manager universe shortens their time horizon and increase their activities, the opportunities may well be in doing the opposite—fishing where the fishermen aren’t.[9] Reinforcing one of the few durable investment advantages—a long-term investment horizon.

We think this changing nature of active management is therefore an opportunity and an advantage for us at Morningstar Investment Management. Our investment process is designed to opportunistically buy assets and patiently hold them until they appreciate. At times this means that we are well out of step with markets as we wait for prices to return to their long-term fair values, but we believe that we will significantly help investors meet their goals in the long run.

Of course, we can’t do this without their help. Changing strategies midstream can destroy value for investors because it often means selling low and buying high—something commonly referred to as “chasing returns.”

Financial advisers can help clients stay the course by reminding them of the big picture and keeping their focus on the long term.

[1] https://www.nytimes.com/2015/10/25/magazine/should-you-be-allowed-to-invest-in-a-lawsuit.html

[2] “Being passive” is in fact still an active choice. As Lasse Pederson pointed out, even “passive” managers of indexes are required to trade[2] due to buy-backs, dividends, re-constitutions and corporate actions, often with active investors on the other side. This isn’t talked about often but could be argued as a potential source of alpha. https://www.tandfonline.com/doi/full/10.2469/faj.v74.n1.4

[3] Albert Einstein supposedly said that compound interest was the eighth wonder of the world, and even modest returns compounded over very long time periods turn into large sums. Legendary investor Warren Buffett said his life has been the product of compound interest.

[4] In the BlackRock’s October 2017 Viewpoint, they point out that the average creation/redemption was 11% of secondary daily ETF flow and 5% of all US stock trading.

[5] https://www.troweprice.com/content/dam/ide/articles/pdfs/2019/q3/the-revenge-of-the-stock-pickers.pdf

[6] This potentially increases non-fundamental information and reducing efficiency. The more trading of baskets of stocks via ETFs, the more this can impact prices of the underlying basket of stocks. https://www.nber.org/system/files/working_papers/w20071/w20071.pdf

[7] Who coauthored a 2009 paper that introduced the active share concept, and identified in a 2016 paper the relationship between active share and holding periods.

[8] The challenge is that most arbitrageurs manage other people’s money, and the fund manager may be fired before their long-term investments deliver results. The irony of the lack of competition for long-term investment ideas due to the institutional limits to arbitrage is that the benefits of compounding returns is best over very long horizons.

[9] An expression that’s a clever contrarian twist on Charlie Munger’s advice to fish where the fish are, borrowed from Jeremy Hosking, an outstanding investor of the eponymous Hosking Partners LLP.

Since its original publication, this piece may have been edited to reflect the regulatory requirements of regions outside of the country it was originally published in. This document is issued by Morningstar Investment Management Australia Limited (ABN 54 071 808 501, AFS Licence No. 228986) (‘Morningstar’). Morningstar is the Responsible Entity and issuer of interests in the Morningstar investment funds referred to in this report. © Copyright of this document is owned by Morningstar and any related bodies corporate that are involved in the document’s creation. As such the document, or any part of it, should not be copied, reproduced, scanned or embodied in any other document or distributed to another party without the prior written consent of Morningstar. The information provided is for general use only. In compiling this document, Morningstar has relied on information and data supplied by third parties including information providers (such as Standard and Poor’s, MSCI, Barclays, FTSE). Whilst all reasonable care has been taken to ensure the accuracy of information provided, neither Morningstar nor its third parties accept responsibility for any inaccuracy or for investment decisions or any other actions taken by any person on the basis or context of the information included. Past performance is not a reliable indicator of future performance. Morningstar does not guarantee the performance of any investment or the return of capital. Morningstar warns that (a) Morningstar has not considered any individual person’s objectives, financial situation or particular needs, and (b) individuals should seek advice and consider whether the advice is appropriate in light of their goals, objectives and current situation. Refer to our Financial Services Guide (FSG) for more information at morningstarinvestments.com.au/fsg. Before making any decision about whether to invest in a financial product, individuals should obtain and consider the disclosure document. For a copy of the relevant disclosure document, please contact our Adviser Solutions Team on 02 9276 4550.