The Key to Personal Financial Planning: Being Lazy

There are benefits to following a simplified approach.

By Samantha Lamas, Senior Behavioural Researcher

The problem: So many options overwhelm and overcomplicate personal financial plans.

Many of us want to improve our finances, but that’s much easier said than done. The truth is, it’s hard to make sense of all the tools, options, and information at our disposal.

If you’re feeling this same stress, you’re not alone. According to the American Psychological Association, most adults in the United States reported that money was a significant source of stress.

Furthermore, our research has shown that a lack of confidence in making financial decisions is a primary reason why investors hire financial advisors and keep them. Although helping investors build confidence in managing their money plays a big role in financial advisors’ value, this research speaks to the prevalence of money-related stress and lack of confidence.

To make matters worse, the financial industry can sometimes add fuel to the fire with the rate at which it introduces state-of-the-art financial products, shiny new tools, and novel investing opportunities. These tools offer investors new opportunities but are also often overwhelming.

What happens: Mistakes and avoidance.

So what happens when people are faced with monumental decisions with dizzying arrays of choices? There are a few possibilities.

Some people may excel and use these tools and options to create financial plans perfectly tailored to their circumstances. Others may fall into the trap of inertia, where they avoid the decision altogether. Another group of individuals may instead do “too much.”

Research has noted that some investors overtrade, leading to overall poor performance and lost returns. Some investors are also prone to overconfidence, which may prompt them to take part in financial opportunities that they do not have enough experience in and are bound to make mistakes.

What to do instead: Personal finance simplified.

Instead of jumping on every investing trend or obsessively watching personal finance videos, many individuals may benefit from “being lazy.”

Now, this is not a recommendation to disengage and leave your financial future to fate. Instead, it means designating a “too hard” pile, using handy rules of thumb, and automating wherever you can.

1. Too hard, don’t care. (THDC—let’s make this abbreviation a thing!)

This idea from Morningstar’s Christine Benz (inspired by the late Charlie Munger) is worth repeating. As Benz explains, she ignores investments, economic information, and even financial information that can be categorized as “too hard.” Her designation of “too hard” has grown to include not just items that are too complicated but also those that are too time-consuming or detailed or feature fleeting short-term fluctuations. For example, her current “too hard” pile includes individual stocks, frequent rebalancing, leveraged-type investments, short-term market forecasts, and short-term market news. Take the time to make your own list of any items that do not matter to you and your long-term financial goals. Then, actively ignore these things when they come about. This may require you to turn off news notifications or unfollow financial influencers who are constantly chasing the next get-rich-quick investing scheme.

2. Use rules of thumb.

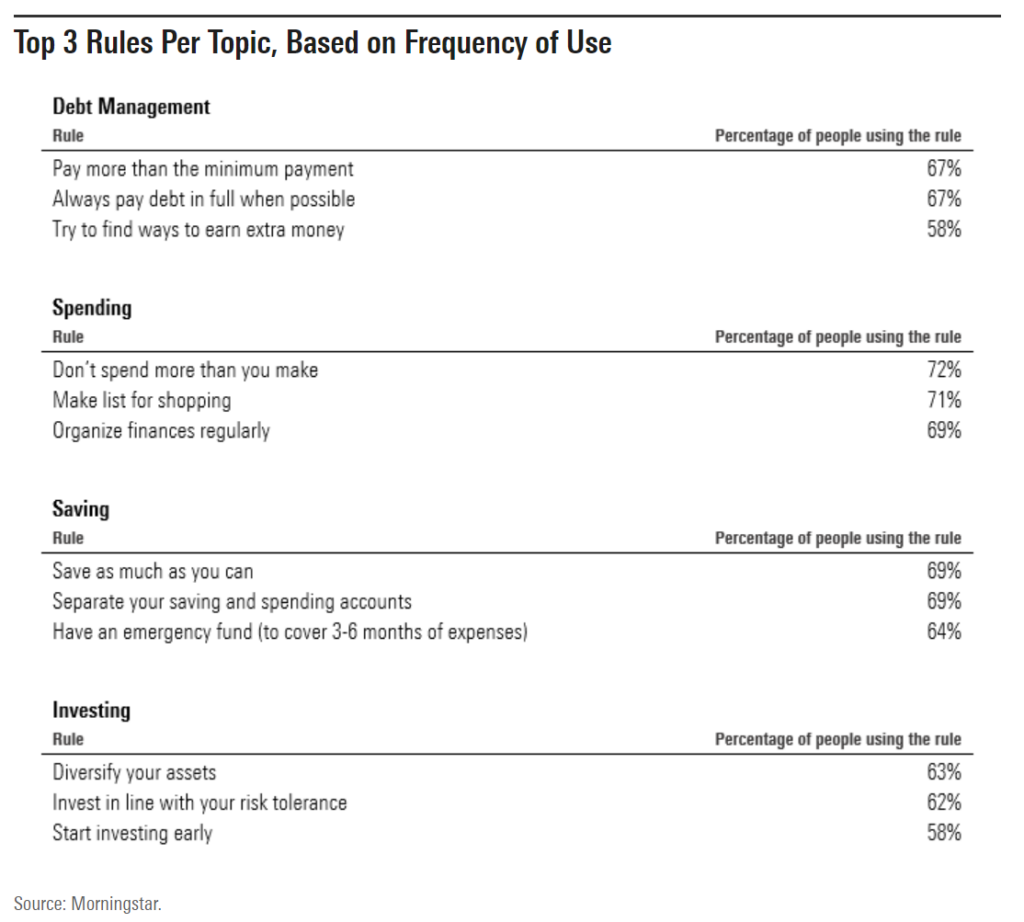

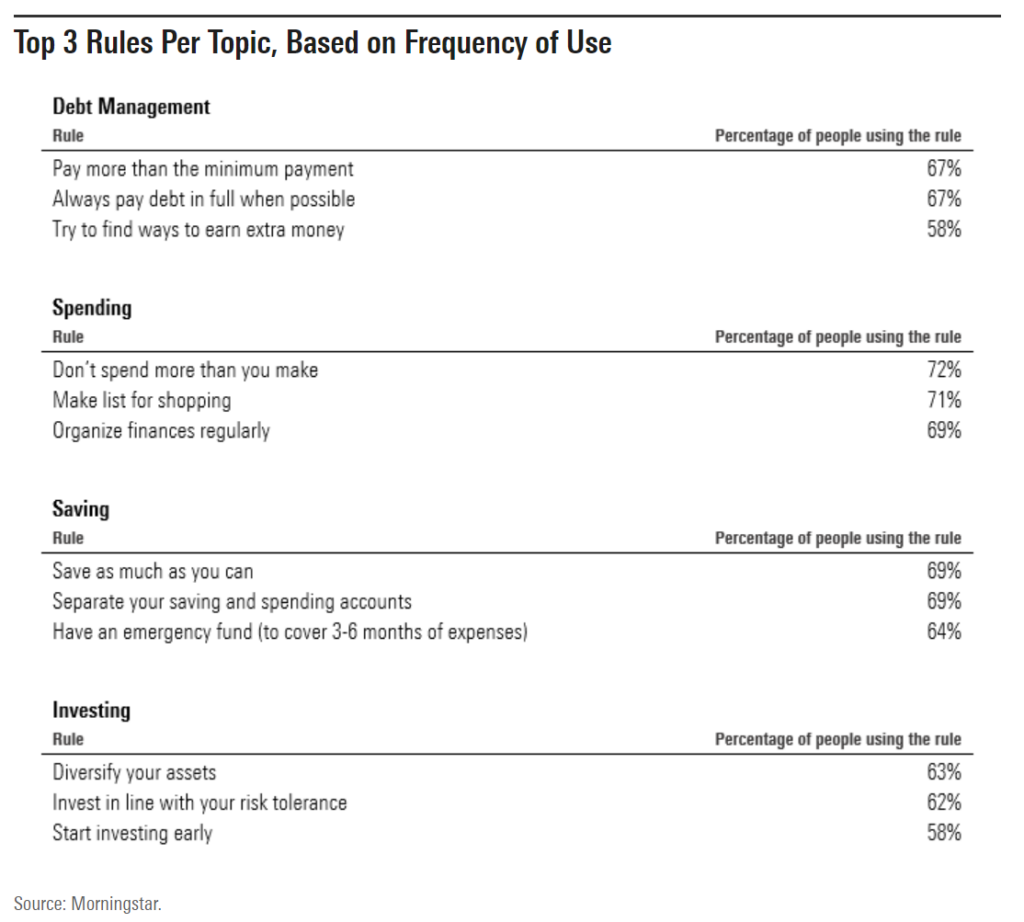

We’re all guilty of assuming that the more advanced (aka complicated) a concept, the better, but this isn’t always true. When it comes to personal finances, sometimes the simple rule of thumb may be better for you than a complicated model or multistep decision process. In past research, we looked at the correlation between common financial rules of thumb and financial well-being. Although we didn’t find that any one rule was more impactful than the rest, we did find strong positive relationships between a person’s habitual use of rules and financial well-being. In other words, find a sensible rule of thumb that you can stick to, then stick to it. For inspiration, here are the top rules that people followed, as reported in our data, separated by financial topic.

3. When you can, automate the decision.

To make a decision as easy as possible, use technology to automate the process. Nowadays, most of us can set up automatic transfers on our bank apps to move money from our checking accounts to our savings accounts or automatic increases of our retirement contribution rates that correspond to our raises. This is the ultimate “lazy” way to personal finance because once you set up the automated process, the key is to not touch it.

Since its original publication, this piece may have been edited to reflect the regulatory requirements of regions outside of the country it was originally published in. This document is issued by Morningstar Investment Management Australia Limited (ABN 54 071 808 501, AFS Licence No. 228986) (‘Morningstar’). Morningstar is the Responsible Entity and issuer of interests in the Morningstar investment funds referred to in this report. © Copyright of this document is owned by Morningstar and any related bodies corporate that are involved in the document’s creation. As such the document, or any part of it, should not be copied, reproduced, scanned or embodied in any other document or distributed to another party without the prior written consent of Morningstar. The information provided is for general use only. In compiling this document, Morningstar has relied on information and data supplied by third parties including information providers (such as Standard and Poor’s, MSCI, Barclays, FTSE). Whilst all reasonable care has been taken to ensure the accuracy of information provided, neither Morningstar nor its third parties accept responsibility for any inaccuracy or for investment decisions or any other actions taken by any person on the basis or context of the information included. Past performance is not a reliable indicator of future performance. Morningstar does not guarantee the performance of any investment or the return of capital. Morningstar warns that (a) Morningstar has not considered any individual person’s objectives, financial situation or particular needs, and (b) individuals should seek advice and consider whether the advice is appropriate in light of their goals, objectives and current situation. Refer to our Financial Services Guide (FSG) for more information at morningstarinvestments.com.au/fsg. Before making any decision about whether to invest in a financial product, individuals should obtain and consider the disclosure document. For a copy of the relevant disclosure document, please contact our Adviser Solutions Team on 02 9276 4550.