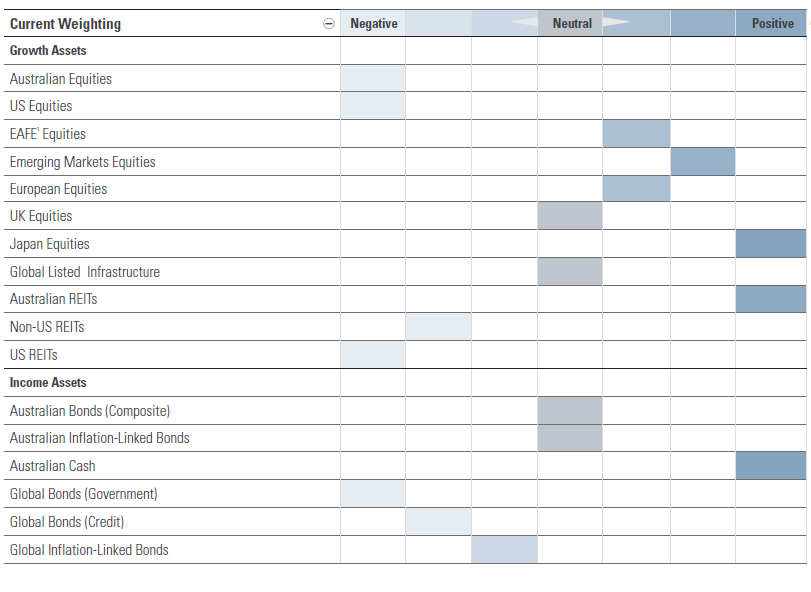

Asset allocation

This foundation of our investment process involves the continuous analysis of asset class valuations using our dynamic asset allocation framework. This way, we establish which asset classes are undervalued and overvalued, relative to their ‘true value’, also known as ‘intrinsic value’. In practical terms, we’re seeking to invest in assets that are cheap or, undervalued.

Then we look at investor sentiment. If everyone is buying into an asset class, it’s likely that it’s a very crowded position. This opens you up to the risks associated with a change in investor behaviour. If sentiment towards the asset class changes, there’s a risk of significant capital loss when investors sell out, particularly where valuations are not underpinned by fundamentals. The output of this process determines the weight of an asset class in our investment solutions.

Click on the image below to see our current view on asset classes.

Adviser Toolkit

The Adviser Toolkit has been designed to support you keeping your clients up to date with their investments.

Private: How we look after your savings

- A key focus on risk management, not just the potential for returns

- Increasing your buying power

- Today’s best investment opportunities