From the Desk of the CIO: Matt Wacher Shares What’s Top of Mind, November 2024

By Matt Wacher, CIO, APAC

Key takeaways:

- Market preparation is more effective than prediction for events like elections, ensuring portfolios are resilient to multiple outcomes.

- Historical analysis shows that starting valuations are more influential on long-term returns than the political party in power.

- Efficient markets quickly price in election-related information, making it difficult to profit by speculating on election outcomes.

Donald Trump has won the White House. After months of campaigning, we finally have an answer: The Republicans have reclaimed the White House and the Senate, while control of the House of Representatives remains uncertain.

Financial markets have already reacted. US equity market is up by 2.5%, while European and Chinese stocks saw a decline. The US dollar strengthened against major currencies, including the AUD as Trump’s stance on tariffs is expected to put upward pressure on the dollar. Meanwhile, 10-year Treasury yields rose above 4.4%, reflecting the increased likelihood of more fiscal spending if Republicans control both the Senate and the House.

Our approach to this event has been the same as always: Prepare rather than predict.

How do we prepare? By striving to build diversified portfolios that are not overly exposed to any single outcome. As long-term investors, we evaluate assets based on the value of their future cash flows, recognizing that elections often have only limited long-term impact However, now that the election is over, we’re ready to respond. If markets overreact, our decisions will be guided by an assessment of long-term value rather than emotion.

Our analysis of presidential cycles since 1881 shows starting valuations play a larger role in returns than the party in the White House.

Prepare, Don’t Outguess

Investor Howard Marks famously stated, “You Can’t Predict You Can Prepare.” This advice is particularly relevant in investing, especially during events like elections. Presidential elections bring a set of clearly defined outcomes, but they are intensely scrutinized by market participants, so any news about election odds is typically quickly priced into markets, making it unlikely that investors can profit by guessing the outcome.

Preparation, however, takes on a different meaning. For elections, it involves simulating various outcomes and understanding their potential impact on portfolio positions. As fundamental investors, we focus on how election outcomes might affect an investment’s long-term earnings power. For many assets, elections have a negligible direct impact. However, for a subset of assets, public policy-such as regulation or trade policies-can have significant consequences. Election preparation involves conducting scenario analysis to determine how a political party or individual candidate’s policy agenda may impact an assets price, with the goal being to make sure that these risks are well-balanced.

Can You Profit from an Election?

Markets are forward-looking mechanisms that reflect the most probable set of future outcomes at any given point in time.

The notion that markets reflect public information, making them difficult to beat, was popularized by Eugene Fama in his Efficient Market Hypothesis (EMH) in the 1960s. Early work in this field relied on empirical research known as event studies. These studies analyzed well-defined events, such as earnings announcements, and tracked the asset’s price before and after the news became available. In these controlled settings, markets are highly effective at instantly reflecting new information into prices, making it very challenging to profit from short-term news.

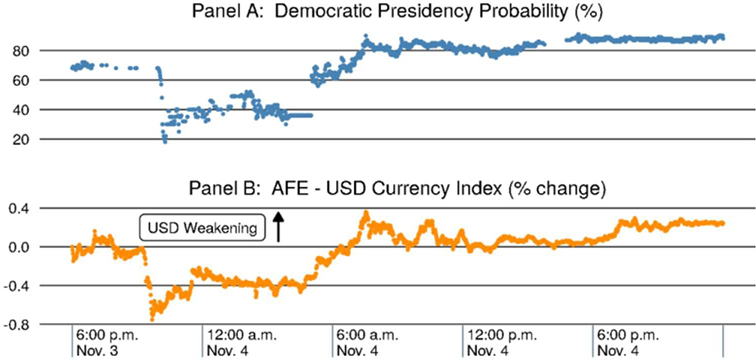

Exhibit 1 illustrates the changing odds of Joe Biden winning the 2020 presidential election according to the betting market Predictlt in Panel A, tracked during the night of the last presidential election. Panel B shows the price of a basket of major currency exchange rates against the dollar, which moved in almost perfect correlation. The odds started around 70%, then dropped to 20% as early results favored Republicans, only to rise back to 90% as more results surfaced.

Prediction markets started pricing in a 90% chance of a Trump victory around 10:30pm Eastern time, well before the outcomes in key swing states were called. Major currency and equity markets also responded instantly to the changes in odds.

Exhibit 1: Instant Pricing of Election Odds

Source: DeHaven et al 12024) “Minute-by-Minute: Financial Markets’ Reaction to the 2020 US Election,” Cornell University.

So, is there any way to benefit from elections? While informational efficiency makes profiting difficult, one of the most common mistakes markets make is overreacting to information. For example, while Chinese stocks were down on news that is expected to Trump win the presidency, we may conclude that the market misjudged the magnitude, providing an opportunity to add to our position.

Elections can, therefore, create opportunities for investors who are prepared to capitalize on market overreactions. Being able to act on these opportunities requires a disciplined process and preparation about an asset’s potential long-term election impact.

Post-Election: Focus on What Matters Most

With the election results pointing to a Republican victory, attention now shifts to the potential impact of the Trump presidency on financial markets. This raises the question: How important is the presidential party in determining return outcomes?

We analyzed data from the past 36 presidential terms, spanning from James A. Garfield’s inauguration in 1881 through Joe Biden’s tenure. Using Robert Shiller’s long-term dataset. we examined US stock market performance incorporating the two months prior to each inauguration to account for the market response to the election outcome.

Exhibit 2 reveals that presidential party affiliation accounts for less than 1% of the variability in returns across presidential terms, indicating a negligible impact. In contrast. starting valuations, as measured by the CAPE Ratio, explain 17.8% of the differences in returns across presidential cycles.

The takeaway? Valuations are a far superior predictor compared to the party occupying the White House.

Exhibit 2: Starting Valuations More Important than Party Affiliation

Source: Robert Shiller data library, Morningstar Wealth analysis.

In the days ahead, predictions will emerge about how a Trump presidency could influence returns. This analysis serves as a reminder that valuations are likely a more reliable predictor than who’s in the White House.