A note from the CIO

A note from Matt Wacher, Chief Investment Officer, APAC.

Your clients’ portfolios

After a strong first half of 2021, performance across your clients’ investment portfolios experienced some volatility in July. While your clients’ portfolios remain on track to achieving their objectives, it is important to remember that nothing goes in a straight line. The investment team does not believe that the fundamentals for the companies held in your clients’ portfolios have changed. As a result, the recent volatility has provided the investment team with buying opportunities that have been incrementally added to the positions held within your clients’ portfolios through this weakness.

Investment market context

Since November 2020, there has been a strong shift to value stocks from the market’s long-term preoccupation with growth stocks (think ‘Big Tech’ and Tesla). Since mid-June this reversal has backtracked, meaning your clients’ investment portfolios have given back some of the impressive gains they have made over the last six months.

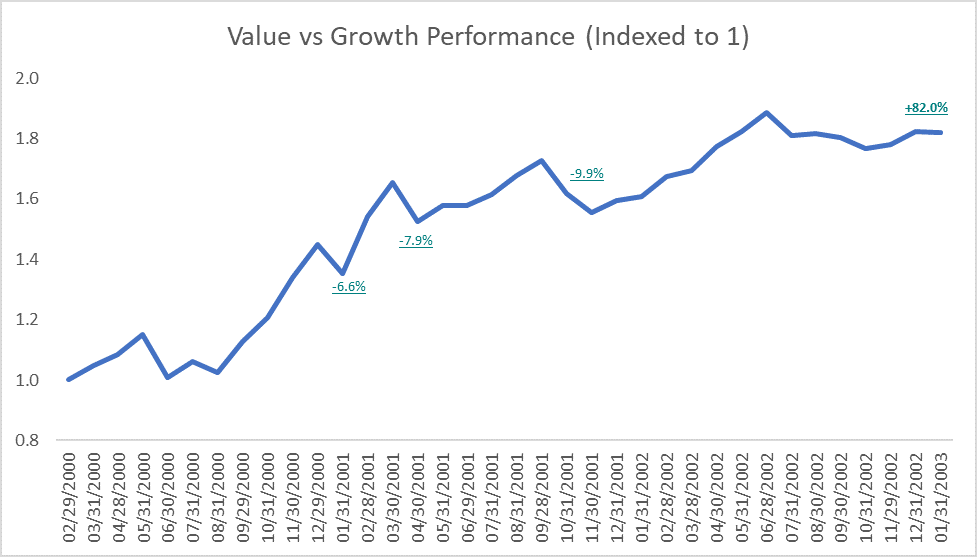

Research shows that value stocks tend to outperform growth stocks over the long term. The last 10 years have been an anomaly in this sense. Value tends to be particularly effective and deliver outsized returns at reversal points, like post the 2000 tech wreck. The chart below shows the three years post the 2000 tech wreck when value outperformed growth by a massive 82%. Even so, the path to success for value was bumpy. During this period, the style also experienced some large drawdowns relative to growth. If investors had lost faith and exited their positions, they would have missed out on outsized returns.

Source: Factset. Index Russell 1000 Value index minus Russell 1000 Growth Index.

Pullbacks like those currently being experienced are normal. The recent sell-off in value stocks was driven by concerns regarding the delta variant of COVID-19, uncertainty about how central banks will respond to rising inflation, and expectations that the recent OPEC+ deal will detrimentally increase supply. The latter has had the most impact on your clients’ investment portfolios.

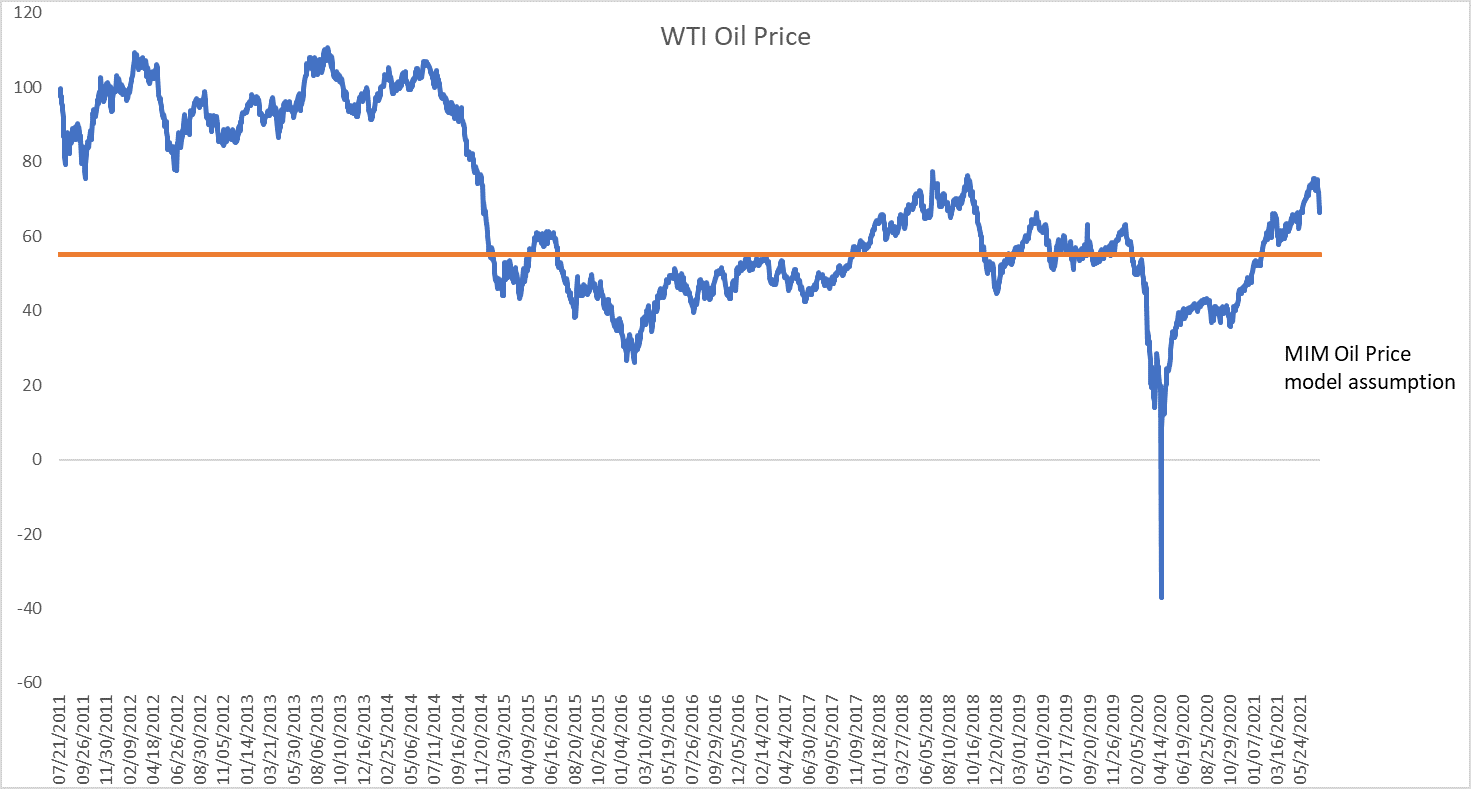

One of the portfolios’ higher conviction valuation positions is energy. You may have noticed that the oil price fell almost $10 in 4 trading days last week. While this is a big price move, it only pulled prices back to levels seen at the end of May and remains well above the assumption in our model.

Source: Factset

The positioning in this sector is deliberate and a function of superior forward-looking return expectations for this sector as determined by the investment team’s valuation-driven investment approach. Embedded in the investment framework is the concept of a “margin of safety” that aims to ensure we are investing or adding to those positions where the intrinsic value is meaningfully higher than current market prices. In other words, your clients’ portfolios are designed to take advantage of market gyrations such as what’s been experienced recently.

The investment team has taken advantage of this short-term price weakness on behalf of your clients’ by adding to positions, where we are finding good value. As a reminder, your clients’ portfolios remain on track to achieving their objectives.

Kind regards

Matt Wacher,

Chief Investment Officer

Morningstar Investment Management