Why losing less is so important (est read time: 4 mins)

Compounding is an extremely effective investing tool, says Morningstar Investment Management’s Head of Institutional Portfolio Management and Solutions, Jody Fitzgerald, but it’s important to be aware of its inverse power on the downside.

The difficulties of investing in today’s market

Record low interest rates have created asset price bubbles across many investment markets around the world – in other words, the price you stand to pay for an asset or investment is greater than what it’s worth – also known as its fair value. Avoiding overpriced assets is key to reducing losses. At times like this, what you don’t invest in is as important as what you do invest in.

Identifying value for a smoother ride

When we experience volatile and weak markets, overpriced assets tend to fall the furthest. And more broadly, assets reprice to reflect their true or fair value. A portfolio that’s avoided overvalued stocks can smooth the investor’s journey, enabling them to hold on to more of their money.

A case study: Negative compounding in practice.

Using a $100 investment and 10% interest rate as an example in Morningstar Investment Management’s video, Why Losing Less Is So Important, Fitzgerald acknowledges the passive returns afforded by compounding. “Compounding becomes more and more powerful the longer you’re invested, where effectively the interest that you earn continues to make more money for you.” That $100 becomes $110 after one year, or a $10 return. After another year, 10% delivers $11, without having to add any more capital to the investment.

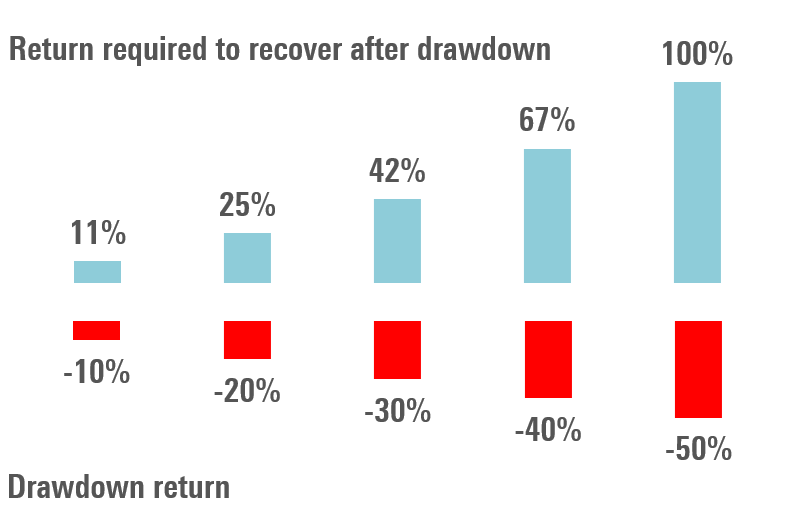

But this power becomes a real threat when compounding applies to losses, rather than gains. Assuming 50% of the initial $100 investment is lost, the investor then needs to regain that $50 – which is now a 100% return. “So, the more you lose in a down market, the more you have to make up in an up market, just to simply get back to square.” The challenge for investors is to preserve capital, setting themselves up for slower but sustained longer-term returns. When investment markets are consistently strengthening and regularly pushing to record highs, as we have seen in recent times, having patience for lower returns relative to the market indices, over the short term, is key.

Prevention is better than the cure

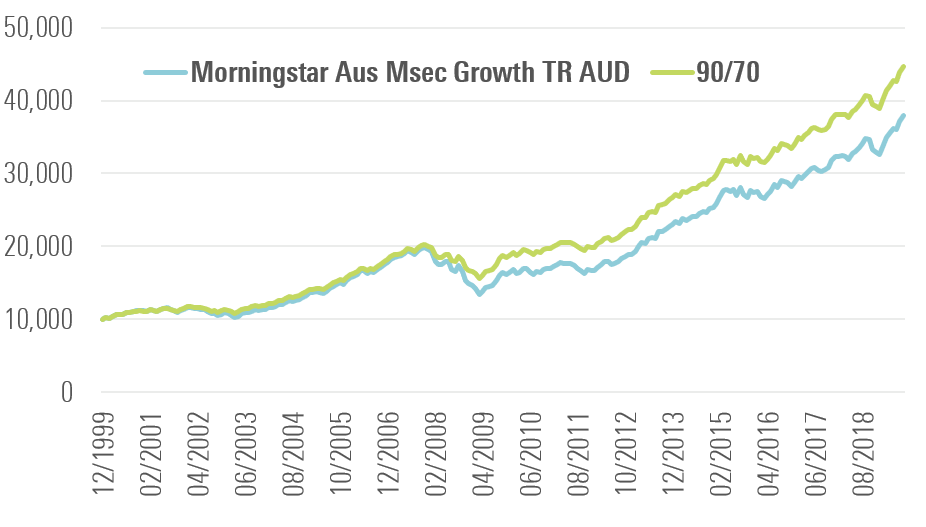

As explained by Fitzgerald in the video, losing less in a down market is crucial for building wealth over the long-term. Morningstar Investment Management has undertaken analysis that shows the benefit of losing less in falling markets. “We’ve simply assumed that if the average growth manager has a positive return, that we’ll only participate in 90% of that return. So, if they return 10%, we will only take 9% of that return. When they have a negative return, we’ll only participate in 70% of that negative return. So, again, if they produce a return of minus 10%, our return would be minus 7%.”

“You can definitely outperform the market in the long run by losing less in downturns. If you lose less in downturns, you’re starting from a higher base to compound off when the market start to strengthen”, Fitzgerald notes.

“You don’t need to fully keep pace with the market when it’s outperforming to do better, as long as you lose less the down markets.”

This Report has been issued and distributed in Australia by Morningstar Investment Management Australia Ltd (ABN: 54 071 808 501; ASFL: 228986) which is regulated by the Australian Securities and Investments Commission. Morningstar Investment Management Australia Ltd is the provider of the general advice and takes responsibility for the production of this report. To the extent the Report contains general advice it has been prepared without reference to an investor’s objectives, financial situation or needs. Investors should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement before making any decision to invest. Refer to our Financial Services Guide (FSG) for more information at https://morningstarinvestments.com.au/fsg.