Portfolio Personalisation Is Here. Are You Ready?

Nowadays, just about everything can be “personalised.” Anyone can receive personalised content from their favorite streaming apps, curate music playlists with a quick tap of a screen, and even get their vehicle seats automatically adjusted to their preferences at the click of a button.

The finance industry cannot escape this wave of personalisation, and we shouldn’t want to. Personalisation can benefit both financial professionals and individual investors.

The ability to understand clients’ needs and personalise to those is a key value-add and differentiator for advisers, putting them leagues ahead of robo-advisers. Additionally, research suggests that personalised goals (and plans focused on those goals) can mitigate the impact of behavioural biases. In other words, personalisation can motivate people to stick to their financial plans, stay on track, and avoid behavioural mistakes.

Given the benefits of personalisation, the next question on a financial professional’s mind may be: What do investors want regarding personalisation in finance?

This was the starting question for our most recent research. Specifically, we endeavored to understand the different portfolio personalisation offerings that investors value, and to what extent. In short, we find that investors’ wants and expectations are complicated and, sometimes, not as clear as we would like.

What We Asked About Portfolio Personalisation

In our research, we provided 982 individuals with a list of common portfolio personalisation offerings. We then asked participants to go through a two-step process to help us better understand their preferences. At the end of the two-step process, we collected a rank ordering of a person’s preferred offerings based on each offering’s importance when personalising their portfolio.

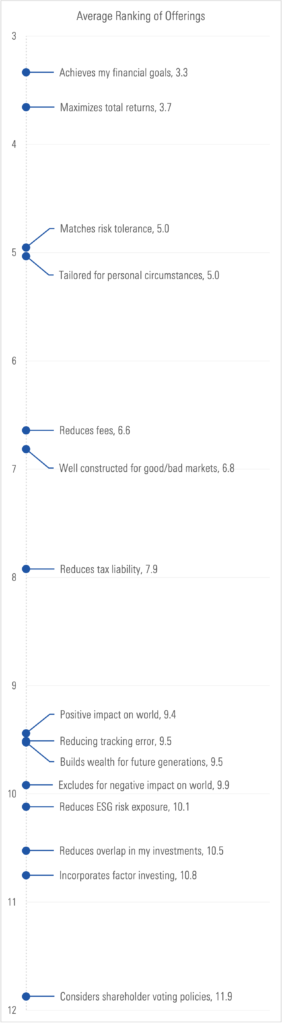

The exhibit below shows the average rankings for each offering, with the most important ranking at the top. Many insights can be gleaned from this graphic—a few prominent takeaways are centered around goals; returns and risk tolerance; and environmental, social, and governance concerns.

Goals Are Still King

The number-one ranked offering, on average, was “achieves my financial goals.” This finding may not be too surprising for most people as it coincides with the approach of goals-based investing and reiterates that investors are centrally driven by their financial goals when investing.

However, we find that this result helps put things into perspective. Despite the multitude of options, tools, and offerings available to investors, it’s important to remember that goals still come first.

Advisers May Need to Help Investors Balance Certain Customisations

Also high on the average ranking list was the offering related to maximising returns. Although returns definitely have a place in financial planning, how highly they are ranked may be a sign of potential confusion.

As financial professionals, we know that there are times when maximising returns could be detrimental to a person’s financial plan. In fact, a portfolio may be perfectly aligned to a person’s financial goals and may purposely avoid maximising returns—for example, when a client is close to retirement. However, our results show that some investors may not be aware of this necessary balance and, instead, may be interpreting returns as a measure of their performance.

ESG Can Be a Great Engagement Tool

One noticeable trend on the average ranking list pertains to ESG-related offerings, all of which tend to be lower on the list. We believe this may be the result of participants starting with a pragmatic view when examining personalisation offerings. People’s first priority is still making sure their financial goals and needs are met, after which they may consider other offerings, like those related to ESG.

It’s also important to note that an average ranking does not perfectly explain the distribution of the data. There’s still a range in how high people rank ESG-related offerings: Some ranked these offerings as higher on their list; some ranked them lower.

We see these results as a reminder that personalisation must be done on the individual level. Some people are highly motivated by ESG, and focusing only on the average ranking may obscure that fact.

At the same time, for many investors, ESG may be a great add-on: Once a person’s financial goals are accounted for, an adviser can bring ESG-related offerings into the discussion. At that point, these offerings can be seen as a way to further engage with your client and build your relationship.

Reducing Costs May Be Underappreciated

The offerings related to reducing fees and tax liabilities landed near the middle of the average ranking list. Given the impact these offerings can have on a person’s bottom line, it’s clear that these offerings should be ranked more highly.

This discrepancy may have many potential causes, such as investors equating cost for quality or being cost-insensitive. Nonetheless, it’s clear that advisers must bridge the gap in people’s understanding of costs and help them see that paying less in costs means reaching your goals sooner.

Just Scratching the Surface of Personalisation

Overall, our results suggest that people’s preferences regarding personalisation are as complex as personalisation itself. That said, we can glean a few key takeaways for advisers from our research:

- Lead with goals. Remember, personalisation is a means to different ends. Make sure to highlight the ends (goals) whenever you can.

- Set up a process to help investors measure the performance of their portfolio. (Hint: This is not returns but rather their on-track-ness to goals.)

- Help investors understand the impact that fees and taxes can have on their bottom line. (For example, pay less and reach your goals sooner.)

Our results indicate that investors continue to have a goal-centric view of investing even when it come to personalisation.

In practice, this means that most investors probably won’t walk into an adviser’s office and ask for anything ESG-related. Instead, many will start with goals. From there, the adviser can help investors understand how some features can act as tools (such as reducing tax liabilities, incorporating a to comply with their values, or incorporating some wiggle room to be flexible to their life changes) to help reach those goals.