Key market developments: June quarter 2023

Overview

- Markets were generally positive in the seconad quarter of 2023, despite a range of conflicting indicators.

- Some economic data such as employment and wages point to a resilient global economy that appears to be handling the burden of steep interest rate rises. Other data, such as PMIs, point to an economic slowdown.

- The prospect of peak rates is supporting markets, along with that of inflation retreating. However, this is happening at different speeds around the world, causing regional performance differences.

- Defensive assets continue to be shaped by higher rates, with short-dated and high-yield debt leading the way in the second quarter despite the risk of a recession if growth slows.

Asset class recap of June quarter 2023

Global shares

The MSCI World Ex-Australia NR Index returned 7.3% over the quarter in local currency terms, increasing the 12-month return to 18.3%. In Australian dollar terms, quarterly returns were 7.6% due to the falling Australian dollar, reflected also in the 12-month return of 22.6%.

Japanese equities (+15.5%) were the strongest performing across developed markets, followed by U.S. equities (+8.7%). In emerging markets, Turkish equities (+21.3%) led the way followed by Polish equities (+17.4%).

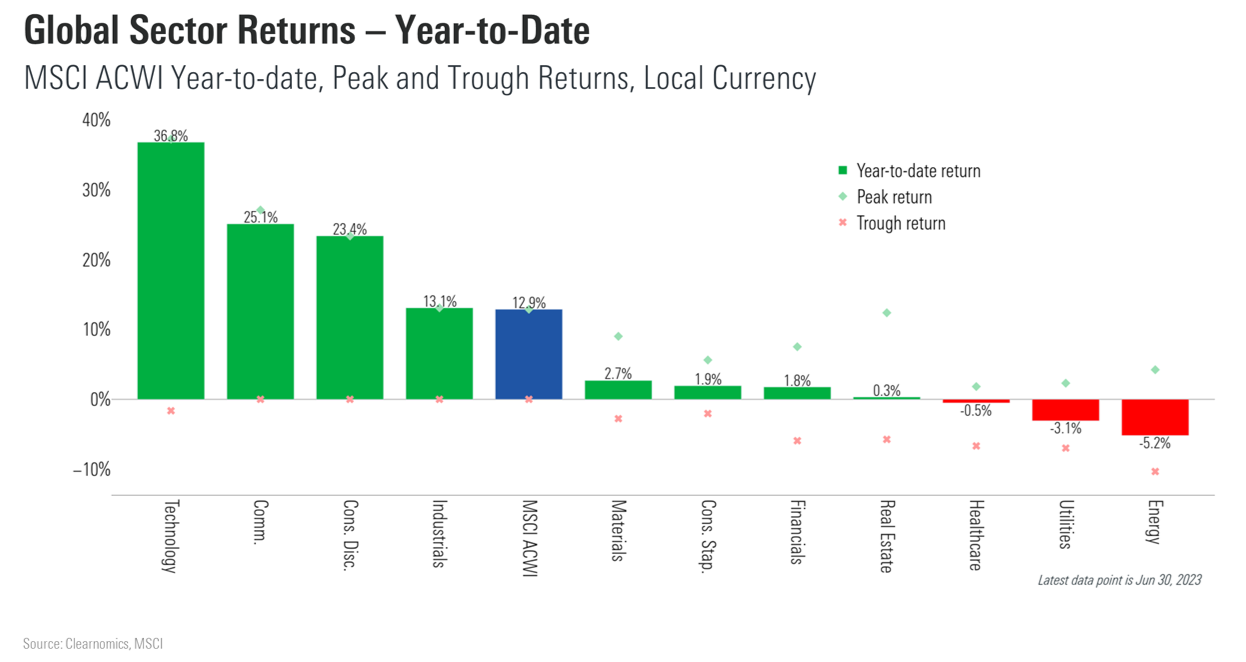

Information Technology and Consumer Discretionary were the strongest sectors over the quarter, returning 15.0% and 11.3% respectively. Communication Services continued a strong start to the year, returning 10.2%. While most sectors achieved positive returns, performance was negative in Energy (-1.1%) and Utilities (-0.7%) for the quarter – all in local currency terms.

Australian shares

Australian shares had a positive quarter albeit lagging global markets, with the S&P/ASX200 index returning 1.0% over the quarter and 14.8% over the financial year. Information Technology (+18.5%), Utilities (+5.5%) and Industrials (+4.3%) were the best performing sectors. Health Care (-3.0%), Materials (-2.6%), Consumer Discretionary (-1.7%), and Consumer Staples (-0.16%) lagged most over the quarter.

Bonds

Bond yields continued to increase over the quarter with core inflation in the U.S. remaining elevated. This rise in yields led to declines in the global benchmark index.

Key stats in local currency terms, Australia Government Bond 10Y: 4.0%, United States Government Bond 10Y: 3.8%.

Property and infrastructure

Domestic listed property & global infrastructure returned positive results throughout the quarter alongside global equities, while global listed property was marginally down for the quarter.

Key stats (in AUD terms): Australian listed property (S&P/ASX 300 A-REIT TR): 3.2%, Global listed property (FTSE EPRA Nareit Dv ex AUS NR Hdg AUD) -0.9%, Global listed infrastructure (S&P Global Infrastructure NR Hdg AUD): -0.7%.

Positioning and outlook

The second quarter of 2023 saw a wide range of outcomes which were generally positive, with some assets remarkably strong.

Once again, inflation and interest rates played a prominent role, with inflation retreating at different speeds across the world as interest rates near their expected peaks. Economic resilience was another major theme for the quarter, with stronger than expected growth.

Gradual relaxation of stimulus measures has not dampened positive momentum. Unwinding the policies implemented after a decade of near-zero interest rates is a complex process; however, inflation is declining, and employment remains stable. Although certain segments of society, particularly households and businesses with debt financing requirements, face mounting pressure, an increasing number of retirees are embracing higher interest rates.

This stands in contrast to the initial consensus that higher interest rates would trigger an economic recession, causing heavily indebted companies without profits to falter and dragging down the markets along with them.

Global Sector Performance, Year-on-Year in Local Currency Terms

Yet, for all the talk about stocks, it is defensive assets that have seen the biggest fundamental shift—and higher than usual volatility.

Bonds delivered mixed results in the second quarter, largely driven by fluctuations in interest rates and inflation. Contrary to concerns, the banking turmoil did not spill over into other sectors or markets, which provided favorable conditions for riskier bonds such as corporate high yield. Shorter-dated bonds also held up better than longer-dated bonds over the quarter.

Investors have clearly moved away from a TINA mentality (There Is No Alternative) to a TARA mindset (There Are Reasonable Alternatives) with major shifts in the investing landscape.

Generally, our portfolios have held up relatively well through these volatile times and they continue to be monitored carefully. The portfolio’s weighting to growth and defensive assets continues to be broadly in line with its target long term asset allocation, with the current environment providing opportunities for nimble, long-term focused investors like Morningstar.

Looking Ahead

With the recent gains in the market, it is natural to question the sustainability of this strength. This raises the question of whether it is advisable to adopt a cautious approach or seize the opportunity for further growth. It is important to recognise that markets typically experience fluctuations, influenced by the underlying fundamentals of increased profits and economic prosperity.

We live in a world of continued uncertainty, many market commentators are saying this rally marks the start of a new bull market and investors should jump into equities to ride this wave. But others argue it’s a bear market rally and investors should get out of stocks while the getting is good.

If the fundamentals remain strong, indicating the potential for continued growth, it may be opportune to take advantage of the positive momentum. However, if there are signs of potential risks, such as overvaluation, economic slowdown, geopolitical tensions, or unfavorable policy changes, it may be prudent to adopt a more cautious approach.

In our view, the question for investors isn’t whether to raise the sails and ride the tailwind of a new bull market, or to batten down the hatches in preparation for a near-term squall, but rather how to best position their portfolios based on today’s valuations.

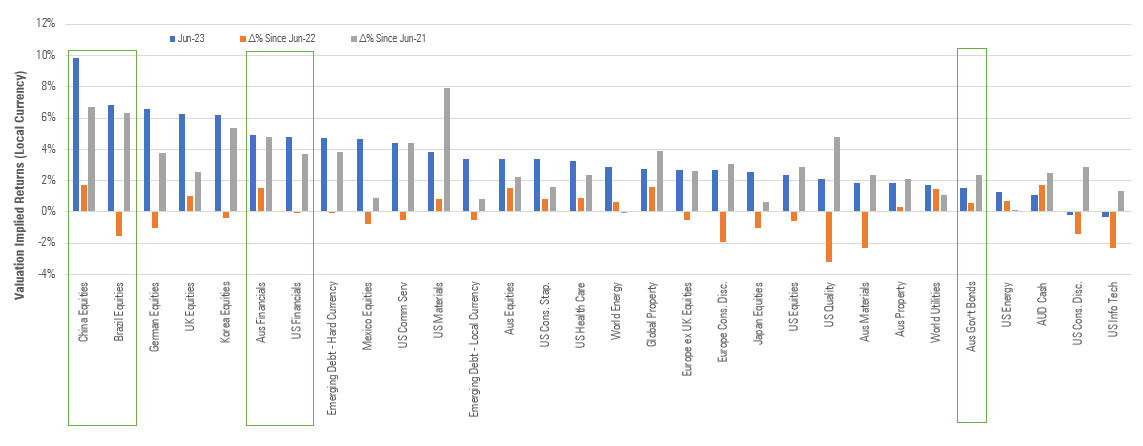

Valuation Implied Returns – Australian Investment Opportunity Set

Over the last 12-months China, Australian cash and Australian government bonds have become more attractive. Emerging market debt, US quality and US IT have become less attractive.

Source: Morningstar Investment Management. As at 30 June 2023

As an investor rather than an economist, and opting for true diversification, we still see merit in multi-asset investing today, with a few selective areas particularly interesting.

Our role is to construct portfolios that help investors reach their long-term goals. Accepting volatility is a prerequisite for good returns in any market, today’s market arguably requires greater care than usual. As advocates of valuation driven investing, we strive to target the best priced assets with careful sizing and diversification. Consequently, as valuations become more attractive, we continue to look to broaden the portfolios exposures across the most attractive asset classes, regions, and sectors identified by our process.

Market Commentary – June 2023

This document is issued by Morningstar Investment Management Australia Limited (ABN 54 071 808 501, AFS Licence No. 228986) (‘Morningstar’). © 2023 Copyright of this document is owned by Morningstar and any related bodies corporate that are involved in the document’s creation. As such the document, or any part of it, should not be copied, reproduced, scanned, or embodied in any other document or distributed to another party without the prior written consent of Morningstar. The information provided is for general use only. In compiling this document, Morningstar has relied on information and data supplied by third parties including information providers (such as Standard and Poor’s, MSCI, Barclays, FTSE). Whilst all reasonable care has been taken to ensure the accuracy of information provided, neither Morningstar nor its third parties accept responsibility for any inaccuracy or for investment decisions or any other actions taken by any person on the basis or context of the information included. Past performance is not a reliable indicator of future performance. Morningstar does not guarantee the performance of any investment or the return of capital. Morningstar warns that (a) Morningstar has not considered any individual person’s objectives, financial situation, or particular needs, and (b) individuals should seek advice and consider whether the advice is appropriate in light of their goals, objectives and current situation. Refer to our Financial Services Guide (FSG) for more information at morningstarinvestments.com.au/fsg. Before making any decision about whether to invest in a financial product, individuals should obtain and consider the disclosure document. For a copy of the relevant disclosure document, please contact our Adviser Solutions Team on 1800 951 999